Capital Gain/Loss Tax Guide

Capital Gain/Loss

A property capital gain is the profit obtained from the sale of a property that was previously purchased at a lower price. This category of income is included in the assessment of the personal income tax (IRS) of non-resident individuals.

Once you sell a property in Portugal, a Capital Gain/Loss Tax Return must be submitted. Even if you sell the property with a loss, a Tax Return must be submitted here until June of the following year.

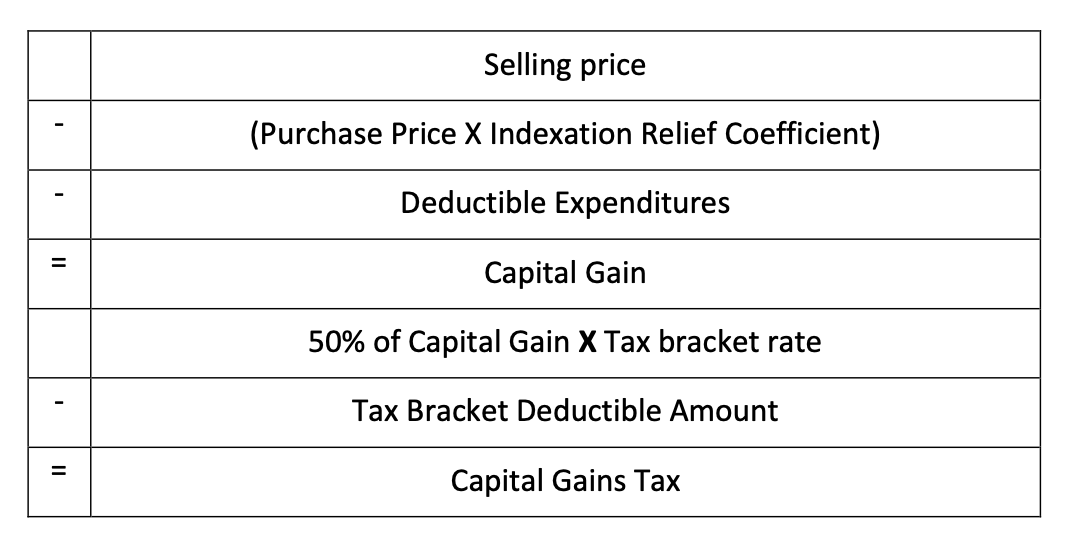

Capital Gain / Loss Tax Computation

Notes:

>Sale Price to consider will be the higher between the amount stated on the deed and the Patrimonial Value

>Purchase Price to consider will be the higher between the amount stated on the deed and the Patrimonial Value

Deductible Expenses

To calculate the taxable capital gain, the following expenses can be deducted from the selling price of the property:

>Invoice/receipt of the real state agency commission paid on the sale of the property, as long as it is mentioned on the deed of sale;

>Additional property improvements made within the last 12 years to increase the capital value of the property (i.e., air-conditioning installation and heating, interior improvements, landscaping, swimming pool, etc.). In order to consider these costs for deduction, these could not have been taken into consideration on the VAT declaration, if your activity was subject to VAT;

>Invoice/receipt of the Energy Certificate Service (if applicable);

>Invoices/receipts of the legal costs related with the purchase of the property, namely:

− Notary costs;

− Land registry office charges

− Property registration charges;

− Property Transfer Tax (IMT);

− Stamp Tax;

In order to be considered as deductible, all expenses must be supported by legal invoices/receipts

with a clear identification of the owner’s name, his Portuguese tax number and the address of the

property;

Non-deductible expenses on the Capital Gain/Loss Tax Return:

> Furniture;

> House appliances;

>

Mobile equipment’s;

> Mortgage, interest or repayments;

>

Construction materials, without the builder invoice or quotation;

>

Council Tax;

>

Lawyer fees;

>

Invoices without name, Fiscal Number, address of the property sold, supplier details, and

description of the services provided;

Insurances;

>

Condominium;

>

Illegible and/or incomplete invoices;

>

Receipts, Pro-Forma invoices and quotations;

>

Bank statements as proof of expenses;

Taxation Rules

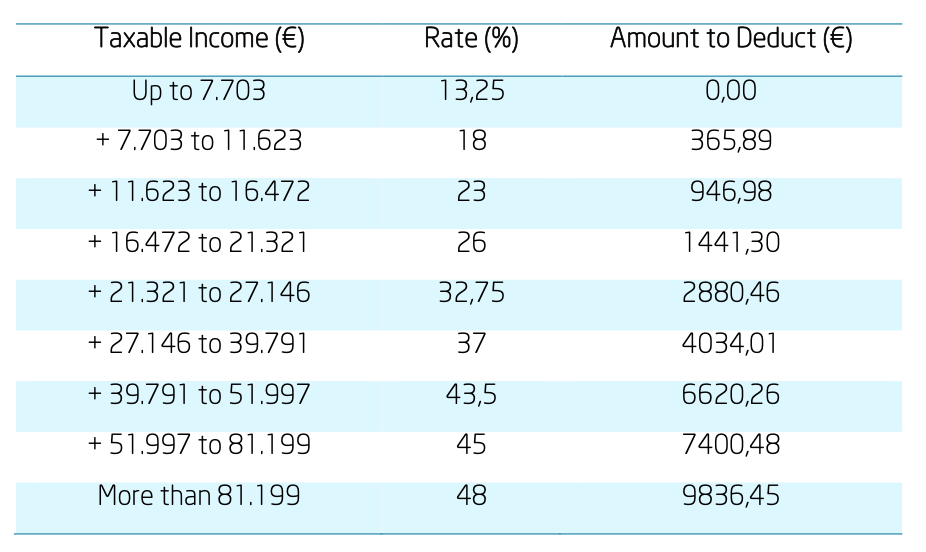

Only 50% of the capital gain will be taxed, and the rate will be applied according to the Portuguese

Tax Bracket:

Your tax bracket will be determined by the sum of your worldwide income, including the capital gain

itself.

Reinvestment in another Primary Residency

If you sell your primary residency in Portugal while being a resident here, and reinvest the proceeds

on another primary residency and fulfil the following rules, you can benefit from the reinvestment

benefits:

> You had to be resident in the property sold, and have that address duly registered in the Tax

Authority system, for the 24 months prior to the sale;

>

You cannot have benefited from this in the year the property was sold, or is the previous 3

years;

>

After the reinvestment, you have 6 months to change your address at the Tax Authorities to

the new property.

Notes:

- You can reinvest in a new property in Portugal or in the European Union;

- The reinvestment can be made 24 months before the sale of the property, or 36 months after

the sale of the property;

- You can reinvest in a new property, or in a land for construction, and for this it is necessary to

have all the invoices regarding the construction works, or you can also reinvest in a life

insurance;

- The value to reinvest is the sale price deducted of the outstanding mortgage taken to

purchase the property;

- You will be taxed on the amount you do not reinvest. Should you reinvest the full amount,

you will not be subject to Capital Gains Tax.

Deadlines:

In Portugal, the tax year is the same as the civil year, from 1st of January to 31st of December.

The Capital Gain/Loss Tax Return should be submitted, between April and June, of the year

after the sale. The tax will be due until 31st of August.

Visit us on Facebook

Visit us on Facebook View us on Twitter

View us on Twitter View us on Instagram

View us on Instagram Join us on LinkedIn

Join us on LinkedIn View our YouTube channel

View our YouTube channel